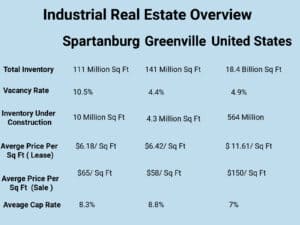

Let’s Discuss the Industrial Real Estate Trends for Spartanburg, Greenville, and the US!

In this blog, we will cover the latest stats on industrial real estate in Spartanburg, Greenville, and across the United States.

Spartanburg

Industrial real estate in Spartanburg is much less expensive relative to average US industrial prices.

The price per square foot to lease is a just over half the average national price of $11.61/ sq ft.

The average price per square foot (sale) is less than 44% of the national average of $150/ sq ft.

From a buyer’s or tenant’s perspective, the Spartanburg market is an affordable option. This is attractive considering Spartanburg’s access to I-85, 1-26, the Greer Inland port, and the major industry in the area.

The most striking negative data point is Spartanburg’s 10.5% vacancy rate.

One reason for the large vacancy rate is that a wave of new supply hit the market as demand began to cool, and it will take a few years for Spartanburg to absorb this inventory.

There is a large spread in vacancy rates according to the class and size of industrial buildings.

The current vacancy rate for industrial and flex buildings 2,000-50,000 sq ft is 4.2%.

For industrial and flex buildings 50,000-150,000 sq ft, the vacancy rate is 5.8%.

But for industrial and flex space over 100,000 sq ft, the vacancy rate is 12.8%

Greenville

Greenville’s existing industrial real estate inventory is larger than Spartanburg’s, but there is much less new construction in the Greenville market.

The average price per square foot for lease and for sale is well below the US industrial average.

Interestingly, cap rates are the higher in Greenville than Spartanburg, and the price per square foot for sale is lower.

Greenville’s vacancy rate is trending slightly less than the national average vacancy of 4.9%.

United States

The average industrial prices for sale and lease across the United States are far more expensive than average industrial prices in both the Spartanburg/Greenville markets.

The average cap rate is lower, indicating that while prices and values are higher on average nationally, returns in Spartanburg and Greenville are higher for inventors.

Forecast

Across the United States, the average annual industrial vacancy rate is projected to be 5.3% by 2028.

The rental growth rate is projected to decline from the current 8.1% to 3.8% by 2028, but Cap rates will remain around the same at 7% in five years.

In Spartanburg, the new wave of inventory will absorb over time.

By 2024, the projected vacancy is 9.3%, and it is projected to hover between 5.7-5.8% from 2026 to 2028. Projected cap rates in Spartanburg are 8.3% in 2028.

In Greenville, vacancy rates are projected to remain low around 4.2% in five years from now with the projected cap rate at 8.9%.

In Summary

Spartanburg does have a new wave of inventory to absorb over the next few years, but both the Spartanburg and Greenville market do have advantages relative to national industrial trends.

If you’d like to discuss this blog or anything relating to commercial real estate, let’s connect!

Emma McDaniel

Source: Costar Data